The month of April serves to raise awareness about the importance of understanding finances and provides an opportunity for individuals, organizations, and governments to come together to address the pressing need for financial education. As we close the books on our Financial Literacy Month celebrations this year, it’s importance that we highlight the importance of efforts to educating students in our communities throughout the school year.

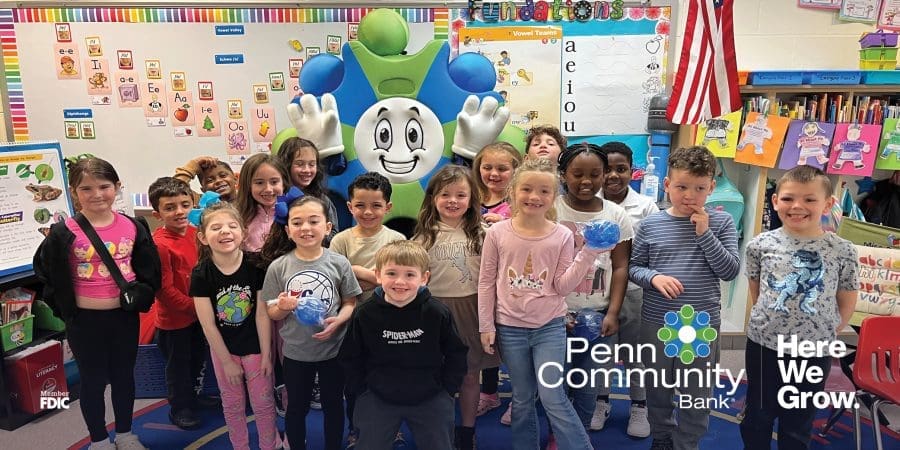

Instrumental in Penn Community Bank’s financial literacy initiative in schools is Antoinette Gellentien – a retired Penn Community Bank financial center manager whose passion for financial education is great enough to (partially) bring her out of retirement.

“After a rewarding career in banking, I realized the part of the job I loved more than anything else was teaching others good saving and spending habits,” says Antoinette.

Drawing from both personal experience and banking resources, Antoinette has developed engaging lessons for grades levels of elementary school through high school. Although the lessons and focus varies for each audience, real-life examples and scenarios are always incorporated. Depending on the age group and geographical area, Antoinette has learned to adapt her lesson to make it most ideal for the students’ situation. For example, some classrooms are majority students from low-income households. With that in mind, shifting the presentation towards earning money and budgeting is likely most beneficial to students.

“I’ve learned that have to always be their level – both in the sense of sitting with them and understanding their unique situation,” she says.

Antoinette’s favorite part of the presentation just so happens to align with what she believes is the most important part: understanding wants versus needs. Her self-crafted “decision tree” serves as an incredible tool in inviting students to pick a “leaf” off a branch and deciding if the phrase listed is a want or need. Doctor visits, video games, healthy food, and scooters are items that are a part of the decision tree, to name a few.

It’s no secret that educating children about finances at a young age sets the stage for a lifetime of informed decisions. Antoinette’s financial literacy presentations in classrooms offer a direct and impactful way to reach students, empowering them with essential knowledge and skills that are bound to last a lifetime. One brief classroom presentation can make all the difference in a young person’s life, empowering them to make sound financial choices and plan for goals.

“I hope students learn that bankers can be your friend and they can look out for you. I want them to trust us and know that we’re not out to get them when they’re older,” says Antoinette.

At Penn Community Bank, we’d dedicated to promoting financial literacy because we know it fosters economic stability and resilience within our communities. To learn more about our financial education tools and communities involvement, please visit www.PennCommunityBank.com.